2. Protected Money

If you find yourself https://paydayloanalabama.com/calera/ head money are from the latest USDA alone, protected loans come from private lenders. The new funds was supported by the latest USDA, and thus it will step in and you can shell out if the debtor defaults towards financing. Brand new credit requirements to have an ensured USDA financing is actually a bit loose as compared to criteria having a primary financing.

Borrowers have to be You.S. customers or eligible low-people. They have to see earnings requirements, nevertheless the restriction money desired exceeds to your direct financing program. Qualified consumers need earn just about 115% of your own average earnings within their town. Like with this new head financing system, individuals who get an ensured USDA loan need certainly to reside in the home as his or her primary residence.

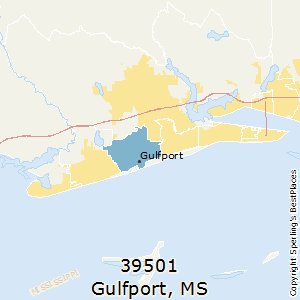

Location standards is a small looser on protected loan system, also. The region should be an outlying urban area, however suburban parts and additionally meet the requirements. Possible individuals is set the address on USDA’s qualification website to ensure that it qualifies to possess a mortgage.

People who rating an ensured loan on USDA could possibly get 100% capital, definition no advance payment is necessary. The fresh USDA will ensure around 90% of loan amount. Individuals may use the latest loans to buy, generate otherwise rehab a qualifying house.

step 3. Home improvement Financing and you can Grants

The new USDA financing program also includes fund and you will provides that assist homeowners modernize, boost or fix their houses and you may provides that assist more mature property owners pay to eliminate safety and health threats from their residential property. Qualified people need earn below fifty% of one’s average earnings because of their city.

As of 2021, the utmost amount borrowed are $20,100000 as well as the limit give amount are $7,five hundred. Residents which qualify for one another a give and you can a loan is blend them, searching a total of $twenty-seven,five-hundred. People who discovered good USDA do-it-yourself mortgage keeps two decades to repay it. Just like the grants always don’t need to feel paid, in the event the a citizen sells their residence within 36 months of getting the latest grant, obtained to pay it straight back.

Both gives and do it yourself loans been directly from the fresh USDA, and availability can vary centered on town and you may time of year. Eligible people can use for a financial loan, grant otherwise both from the the local Rural Innovation place of work.

cuatro. Outlying Construction Site Financing

When you find yourself head and secured USDA financing are available to personal individuals, the fresh service even offers loan software to have groups that provide housing to help you lowest-money or average-income homebuyers. Qualified communities become nonprofits and you can federally recognized tribes. The fresh fund has name limits out of 2 yrs and you will either fees an effective step 3% interest rate otherwise a significantly less than-sector speed, with respect to the financing form of.

USDA technology guidelines gives are supplied so you can nonprofits or federally recognized people that help extremely-lowest and lowest-income someone create their unique land. The new property need to be situated in eligible portion together with people who tend to reside in the newest belongings need certainly to create very of one’s labor of creating the home, which includes assistance from the organization. The fresh new grant currency can be used to let generate individuals to the applying in order to promote supervisory assistance to family, it can’t be accustomed financing the true construction out-of the house.

Exactly who Need to have a beneficial USDA Financing?

When you are to invest in a house, you have got enough decisions and make, for instance the place of the new house, their proportions and its facilities. Be sure to search for the type of mortgage you have made. If or not an excellent USDA mortgage is right for you or not is based toward a number of activities.